Which Of The Following Statements Is True Of Time Value Of Money

What is the Time Value of Money?

The time value of money is a basic financial concept that holds that coin in the present is worth more than the same sum of coin to be received in the futurity. This is truthful because money that you take correct now tin can be invested and earn a return, thus creating a larger amount of money in the futurity. (Also, with future money, there is the boosted risk that the money may never actually be received, for one reason or another). The time value of money is sometimes referred to as the internet present value (NPV) of money.

How the Fourth dimension Value of Coin Works

A unproblematic example can be used to show the fourth dimension value of money. Presume that someone offers to pay yous one of two ways for some work you are doing for them: They will either pay you lot $1,000 now or $one,100 1 yr from at present.

Which pay selection should you accept? It depends on what kind of investment return yous tin earn on the coin at the present time. Since $ane,100 is 110% of $1,000, and then if you believe you can make more a 10% return on the money by investing it over the next year, yous should opt to take the $1,000 now.

On the other hand, if you don't call back you lot could earn more than 9% in the next year by investing the coin, then you should take the hereafter payment of $1,100 – equally long as you trust the person to pay you lot then.

Fourth dimension Value and Purchasing Power

The time value of money is likewise related to the concepts of inflation and purchasing power. Both factors demand to exist taken into consideration along with whatever rate of return may exist realized by investing the money.

Why is this important? Because aggrandizement constantly erodes the value, and therefore the purchasing ability, of money. Information technology is all-time exemplified past the prices of bolt such every bit gas or food. If, for example, you were given a certificate for $100 of gratis gasoline in 1990, y'all could have bought a lot more than gallons of gas than you lot could take if you were given $100 of free gas a decade later.

Inflation and purchasing power must exist factored in when yous invest money considering to calculate your real return on an investment, y'all must decrease the rate of inflation from whatever percentage render you earn on your money.

If the rate of inflation is actually college than the rate of your investment render, and then even though your investment shows a nominal positive return, you are actually losing money in terms of purchasing power. For example, if you earn 10% on investments, but the charge per unit of inflation is 15%, you're really losing five% in purchasing power each year (ten% – 15% = -5%).

Fourth dimension Value of Coin Formula

The time value of money is an of import concept not merely for individuals, but also for making business organization decisions. Companies consider the time value of money in making decisions about investing in new product development, acquiring new business equipment or facilities, and establishing credit terms for the sale of their products or services.

A specific formula can be used for calculating the hereafter value of coin so that it can be compared to the present value:

Where:

FV = the future value of money

PV = the nowadays value

i = the involvement rate or other return that tin be earned on the money

t = the number of years to take into consideration

n = the number of compounding periods of interest per year

Using the formula higher up, let's expect at an example where you have $5,000 and can expect to earn 5% involvement on that sum each year for the adjacent ii years. Assuming the interest is merely compounded annually, the time to come value of your $5,000 today can be calculated equally follows:

FV = $v,000 x (1 + (5% / one) ^ (1 x 2) = $v,512.50

Present Value of Future Money Formula

The formula tin too be used to summate the present value of coin to be received in the future. You lot merely dissever the future value rather than multiplying the present value. This can be helpful in considering two varying present and future amounts.

In our original instance, we considered the options of someone paying your $1,000 today versus $i,100 a year from now. If you could earn v% on investing the money at present, and wanted to know what present value would equal the future value of $one,100 – or how much coin you would demand in hand at present in order to take $1,100 a yr from now – the formula would be as follows:

PV = $1,100 / (1 + (v% / 1) ^ (1 x 1) = $one,047

The calculation above shows you lot that, with an bachelor return of 5% annually, you would need to receive $1,047 in the present to equal the futurity value of $1,100 to exist received a year from now.

To brand things easy for you, there are a number of online calculators to figure the futurity value or present value of coin.

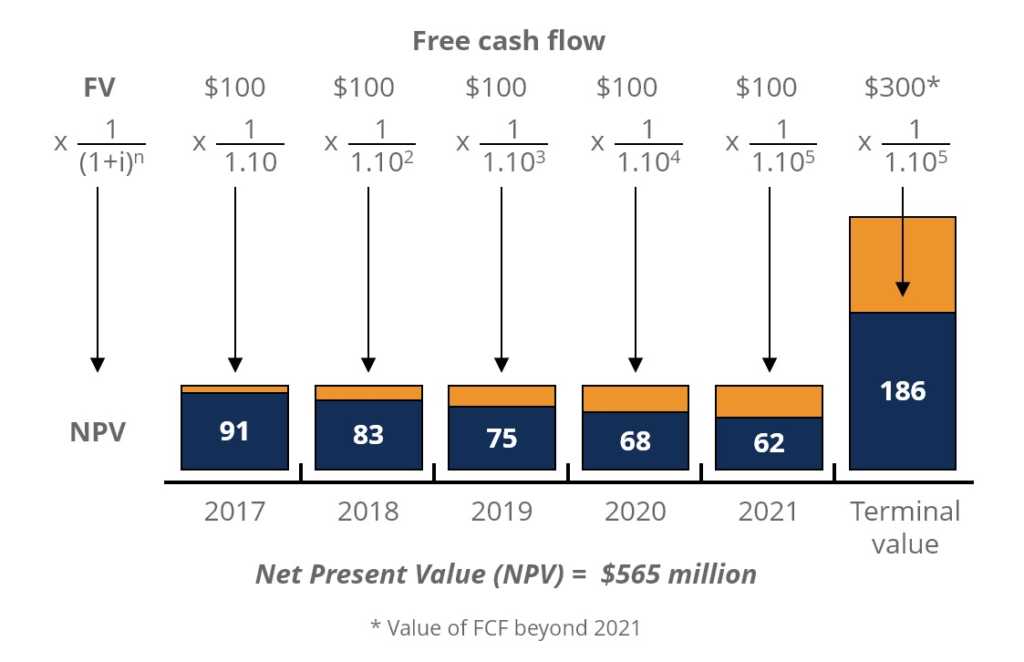

Net Nowadays Value Example

Below is an analogy of what the Net Present Value of a serial of greenbacks flows looks like. As you tin come across, the Futurity Value of cash flows are listed across the top of the diagram and the Present Value of cash flows are shown in blue bars along the bottom of the diagram.

This example is taken from CFI'south Free Introduction to Corporate Finance Grade , which covers the topic in more detail.

Boosted Resources

We hope you've enjoyed CFI'southward explanation of the time value of coin. To learn more about coin and investing, check out the following resources:

- Adjusted Nowadays Value

- Forecasting Methods

- NPV Formula

- Valuation Methods

Source: https://corporatefinanceinstitute.com/resources/knowledge/valuation/time-value-of-money/

Posted by: hollowaylabody1945.blogspot.com

0 Response to "Which Of The Following Statements Is True Of Time Value Of Money"

Post a Comment